Designing a stress-free digital borrowing experience for small business

ANZ • 2019

Tasks

Research

Strategy

Design leadership

Prototyping

Usability testing

Role

Design Lead

An end-to-end service blueprint of the lending journey for small business owners.

Project Goal

To transform ANZ’s small business lending process by digitizing the loan application, reducing paperwork, and enhancing speed and user experience to better support small business owners.

Usability testing using paper prototypes with early concepts.

Synthesising and making sense of our research findings in our project room where we could walk stakeholders through early insights and gather feedback.

Challenge

Our research revealed that ANZ’s manual loan application process was complex, time-consuming, and error-prone, taking up to three weeks just to reach a decision. This lengthy process drove potential customers to alternative lenders who offered faster and more personalized service. Additionally, the complexity of the application led to bank staff re-working or revising 43% of applications, significantly increasing operational costs. ANZ faced the dual challenge of increasing small business lending rates while navigating tighter regulatory requirements.

Approach

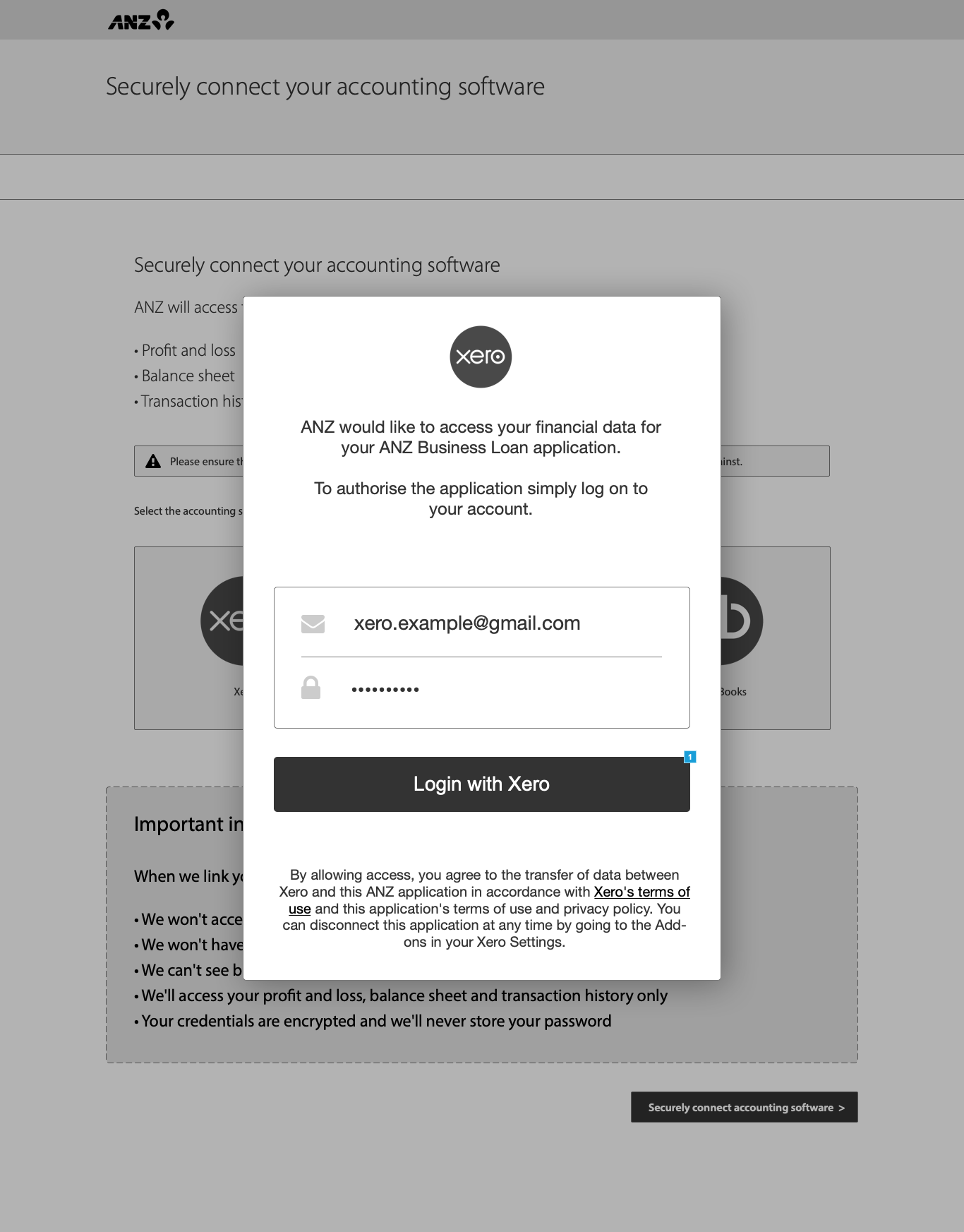

I led the research and UX design for this project, conducting exploratory research to understand pain points in the existing process. These insights guided us to focus on three main goals: enhancing the user experience, finding growth opportunities within regulatory limits, and lowering the cost of loan servicing. We developed a streamlined digital application that allowed small business owners to connect their accounting software directly to their loan application, reducing paperwork and enabling instant decision-making. Additionally, we tested a conversational, guided interface to increase user comprehension and make the experience more engaging and personal.

Placing prototype sketches in hallways meant we could gather feedback from stakeholders in between meetings and rapidly iterate.

By connect accounting software to the application we were able to significantly reduce the application time from weeks to a single day.

Outcome

The new system transformed weeks of paperwork into a seamless, real-time application process, significantly reducing friction for customers. By digitizing and simplifying the loan experience, we boosted user satisfaction, reduced processing time, and positioned ANZ as a more competitive choice for small business lending.

Our final solution allowed business owners to apply for a loan from their mobile, connect accounting software and receive a decision compared to the old paper application process.